A closer look at agency earnings

A closer look at agency earnings

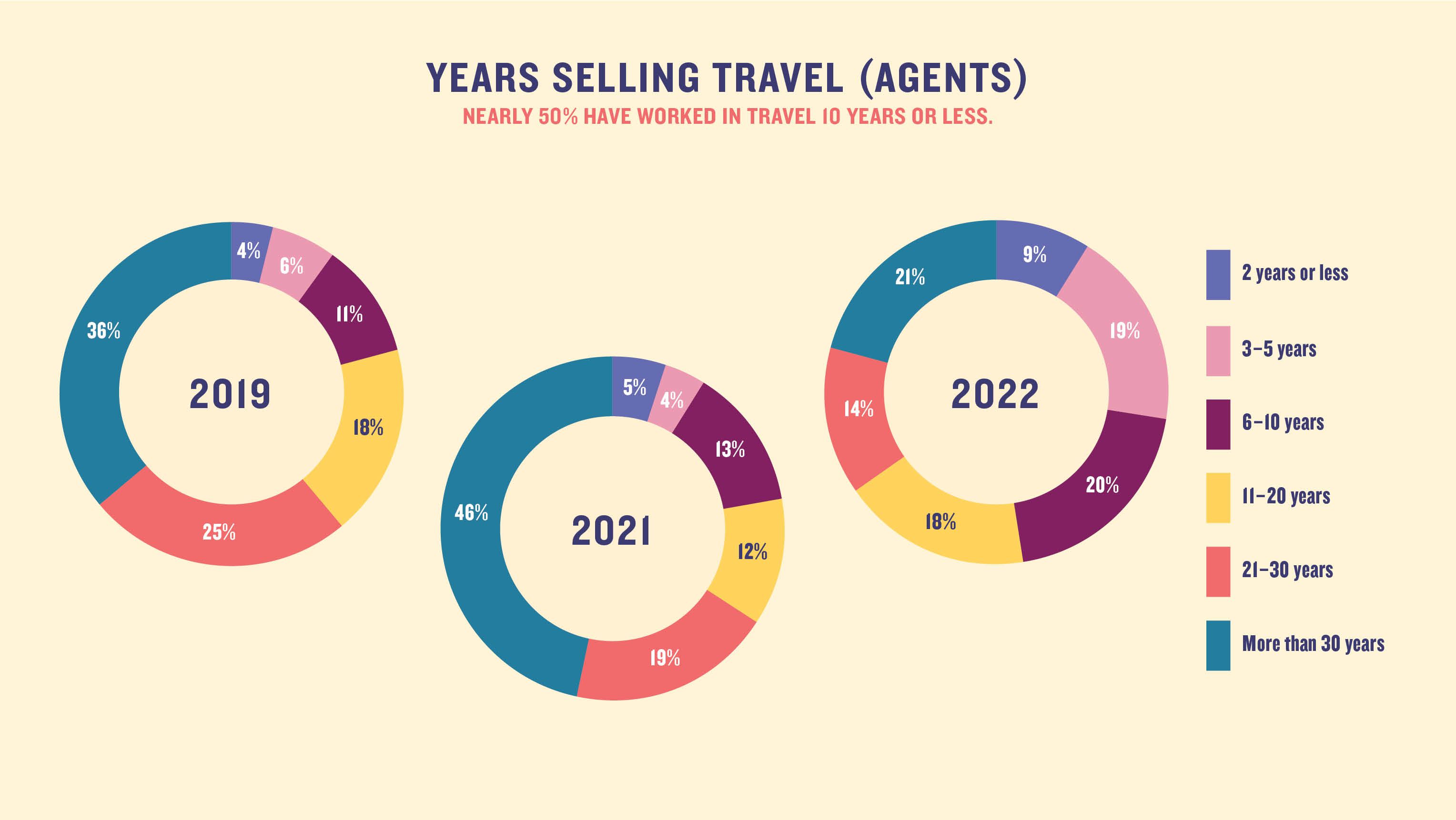

The travel agency community has faced a persistent problem in recent years, one far preceding the pandemic: the aging out of the trade (see chart on Page 17). And while today only 8% of respondents reported being younger than 35, there is evidence that agencies are bringing new advisors into the fold: Almost half of respondents have worked in travel for 10 years or less. In 2019, that figure stood at less than one-quarter, or 21%.

Throughout the pandemic, host agencies in particular have reported influxes of new-to-industry advisors. The Travel Institute said attendance at its introductory web-inars are up 50% since 2019. Those gains have to be couched with the loss of advisors who left the industry during the pandemic, but many indicators point toward a more youthful trade going forward.

— Jamie Biesiada

The survey also found that while nearly one-quarter of traditional agencies, 24%, have been in business more than 30 years, 23% were founded in the past five years. In 2019, that figure stood at just 10%, indicating more new entrants to the agency community.

—J.B.

It takes time to develop a book of business — many agents don’t start making significant income for at least the first year of their business and sometimes more. Fully 69% of respondents working two years or less reported making less than $25,000 annually. For agents in the business more than 30 years, only 26% reported making less than $25,000 annually.

—J.B.

Income levels indicate that lower earners are less likely to be full-time advisors: Most respondents reporting annual incomes of $100,000 or more are full-time agents, and it’s their primary or secondary income source. Those who reported being part-timers are much more likely to earn under $50,000 annually. This highlights a paradigm in the industry: Part-timers are often viewed more negatively than those advisors who devote themselves fully to their travel careers. But in most cases, to earn what many would consider a livable income, advisors need to work for at least a few years to build up their clientele.

— J.B.

One of the fastest-growing segments in the industry has been that of independent contractor (ICs). ASTA has been tracking the growth of the IC segment, which makes up a key part of the Society’s membership base, numbering some 7,000. While many are affiliated with a host agency or consortium, though, they tend to think of themselves as “independent.” In total, 34% of respondents identified themselves as hosted ICs, down 20 percentage points from last year, while 28% identified as fully independent agents, compared with 17% in 2021. But, of that 28%, 66% reported being affiliated with a host agency and 80% reported being members of a consortium.

—J.B.

Regardless of how they self-identify, the home-based segment of advisors is enjoying record sales. Respondents reported their highest gross book-ings yet in 2021, clocking in at $920 million. The previous high was $899 million in 2018.

— J.B.

No matter an advisor’s tenure, income level or sales numbers, though, members of the trade seem to be reaching the kind of clients they want. The majority of respondents, 33%, said their clients book with them for their customer service, followed by personal relationship (31%) and the advisor’s expertise (30%). Only 3% said clients book with them because they offer the best price.

—J.B.